“Our mandate is to invest in the local market,” Managing director and chief executive officer Datuk Kamalul Arifin Othman (pic) told StarBiz in an interview.

PETALING JAYA: Pelaburan Hartanah Bhd (PHB), a subsidiary and operating arm of Yayasan Amanah Hartanah Bumiputera, will focus on three core areas property acquisition, property development and being a master developer.

Managing director and chief executive officer Datuk Kamalul Arifin Othman said PHB would be more active in the local property scene as it sought to buy real estates in other state capitals.

“Our mandate is to invest in the local market,” he told StarBiz in an interview.On the possibility of it going abroad, he said, “It is a possibility that we may one day buy assets overseas.”

Kamalul said that on the local front, PHB would like to have a presence in all the state capitals, including Sabah and Sarawak.

“Our mandate is to invest in the local market,” Managing director and chief executive officer Datuk Kamalul Arifin Othman (pic) told StarBiz in an interview.

“We are actively pursuing our property acquisitions. We are going into property development and more into land banking. We are not going to stop just because the price of land is going up.”

He said PHB wanted to focus on these three areas because it aimed to increase the size of its Amanah Hartanah Bumiputera (AHB) fund.

Kamalul said the fund was launched in 2010 with a size of RM1bil which was sold in three months. “We want to increase the fund size this year, depending on the properties we are going to inject into AHB,” he said.

AHB is the first syariah-compliant fund backed by real estates. Unlike normal unit trust, PHB will buy the asset first and then only raise money.

“We buy the properties and transfer the beneficial ownership to the fund in the sense that every month, the fund is secured with rental guarantee,” he said.

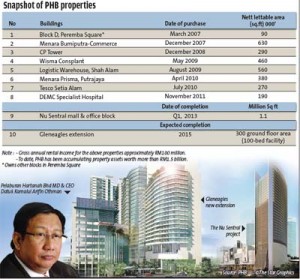

PHB currently has several prominent and strategically located properties in the Klang Valley. The value of its total property assets to-date stands at RM1.5bil, generating a gross annual rental income of about RM100mil. This works out to an annual yield of 6.67%, with 160 tenants over nine projects.

Said Kamalul: “We will focus on acquiring property that will predominantly be completed Grade A buildings, go into property development, which we have already done in KL Sentral, and be a master developer.”

Some of the office buildings in its stable include four out of five blocks in Peremba Square, Menara Bumiputra-Commerce which is next to Sogo departmental store in the city, CP Tower in Section 16 Petaling Jaya, Wisma Consplant in Subang Jaya and Menara Prisma in Putrajaya.

It also owns two retail blocks in Peremba Square, DEMC Specialist Hospital that it purchased in November last year and industrial building Logistics Warehouse in Shah Alam, Selangor.

“We want to diversify our revenue (in order to be resilient),” he said.

Kamalul said besides accummulating property assets for its recurring income, PHB’s second core business was property development.

Its maiden project is Nu Sentral in KL Sentral. With a gross development value (GDV) of RM1.4bil, it will comprise a seven-storey mall with gross floor area of 1.1 million sq ft and nett lettable area of 650,000sq ft. It will be KL Sentral’s first mall.

The second component of the development is a 27-storey office building Menara 1 Sentrum at Nu Sentral with estimated gross floor area of 640,000 sq ft and net lettable area of 450,000 sq ft. It will be built according to specifications of LEED Silver green building. LEED is the acronym for Leadership in Energy and Environmental Design (LEED).

Both components of its Nu Sentral project the mall and the office block are expected to be completed in the first quarter of 2013 and will have about 2,000 parking bays.

In terms of site location and frontage, Kamalul said it would be among the best. A bridge will be constructed to link the mall to the transport interchange.

Possible tenants for the mall include Parkson, cineplex operator Golden Screen Cinemas GSC, Wesria Food Sdn Bhd which will operate and manage a food court, a bowling alley and an MPH bookstore. Mydin will be introducing a new brand at the mall.

PHB will retain ownership of the entire project. “Rental lease will be competitive with other retail lots in KL Sentral,” Kamalul said.

PHB’s second property development is the extension of Gleneagles Hospital that is expected to be completed in three years. It has signed an agreement with Gleneagles to build the medical facilities with a GDV of RM150mil and has signed a long lease with the hospital operator.

The remainder of its five acres at the Gleneagles extension will be used to build serviced apartments and PHB is already in discussions with several operators. PHB will own the asset but it will be managed and operated by another party.

“The patients at Gleneagles Hospital are very high profile. They and their family need a place to stay and rest,” said Kamalul.

On PHB’s plan of becoming a master developer, Kamalul said this would be done at the former Lever Brothers land in Bangsar which it bought from Perbadanan Aset Keretapi.

“We have submitted our masterplan to the City Hall and it is currently being evaluated. We want to be the master developer for that land.

“We are going to plan the development and we will get the developer to build for us. But the important criteria is, they must give value-added proposals. For example, they develop the land and at the same time, provide a tenant to take up a substantial portion of the place.”

Kamalul said the project would be a mixed integrated community development which would include high-end condominium, retail centres and office buidings.

“It will be developed in phases. On the demand side, it will be green in terms of getting the credentials. That will keep us busy for the next several years. There may be opportunities for joint ventures with some of the parties involved,” he said.

Source: The Star Dated: 13/8/2012