Although the construction sector’s outlook is expected to be encouraging this year with the Government announcing a few mega projects in Budget 2015, there are several factors that may affect its growth.

Obstacles to construction growth

Although the construction sector’s outlook is expected to be encouraging this year with the Government announcing a few mega projects in Budget 2015, there are several factors that may affect its growth.

These include the present hazy situation with the downtrend in oil prices, tight fiscal budget measures and the soon-to-be implemented goods and services tax (GST) as well as a possible interest-rate hike.

IJM Corp Bhd chief executive officer/managing director Datuk Teh Kean Ming said the construction industry would be challenging this year.

He said with the depressed oil price scenario and slower gross domestic product (GDP) growth forecast, the Government might exercise caution on development expenditure going forward and compounded by the weak sentiment in the private sector, this year’s construction growth might slow down.

“On the backdrop of a weak ringgit, the possibility of an interest rate hike cannot be discounted. The authorities will have to weigh its impact on the economy taking into account the already high household debts,” Teh told StarBiz.

He did not foresee any setback in the implementation of GST, as this was regarded a positive contributor to the Government’s income and timely in the current weak market situation.

Teh explained that the general construction cost would depend on the extent of input components that attracted the sales and service tax (SST) of 10% prior to GST.

“If the construction cost has 60% of the input components that attract the SST, this will have a cost comparable to the construction cost after GST (since all the input components will have a GST of 6%).

“In other words, if the components that attract SST (prior to GST) are more than 60%, then the construction cost would generally be lower after GST. On the other hand, if they were less than 60%, then the cost would be higher after GST,” he explained, adding that with the record order book IJM had at present, it should be able to ride on the potential lower input cost and opportunities.

Eversendai Corp Bhd executive chairman and group managing director Tan Sri AK Nathan said the sudden plunge in global oil prices had brought about many uncertainties for the overall economic situation.

He said the continuous slump in oil prices could be detrimental to the Malaysian economy.

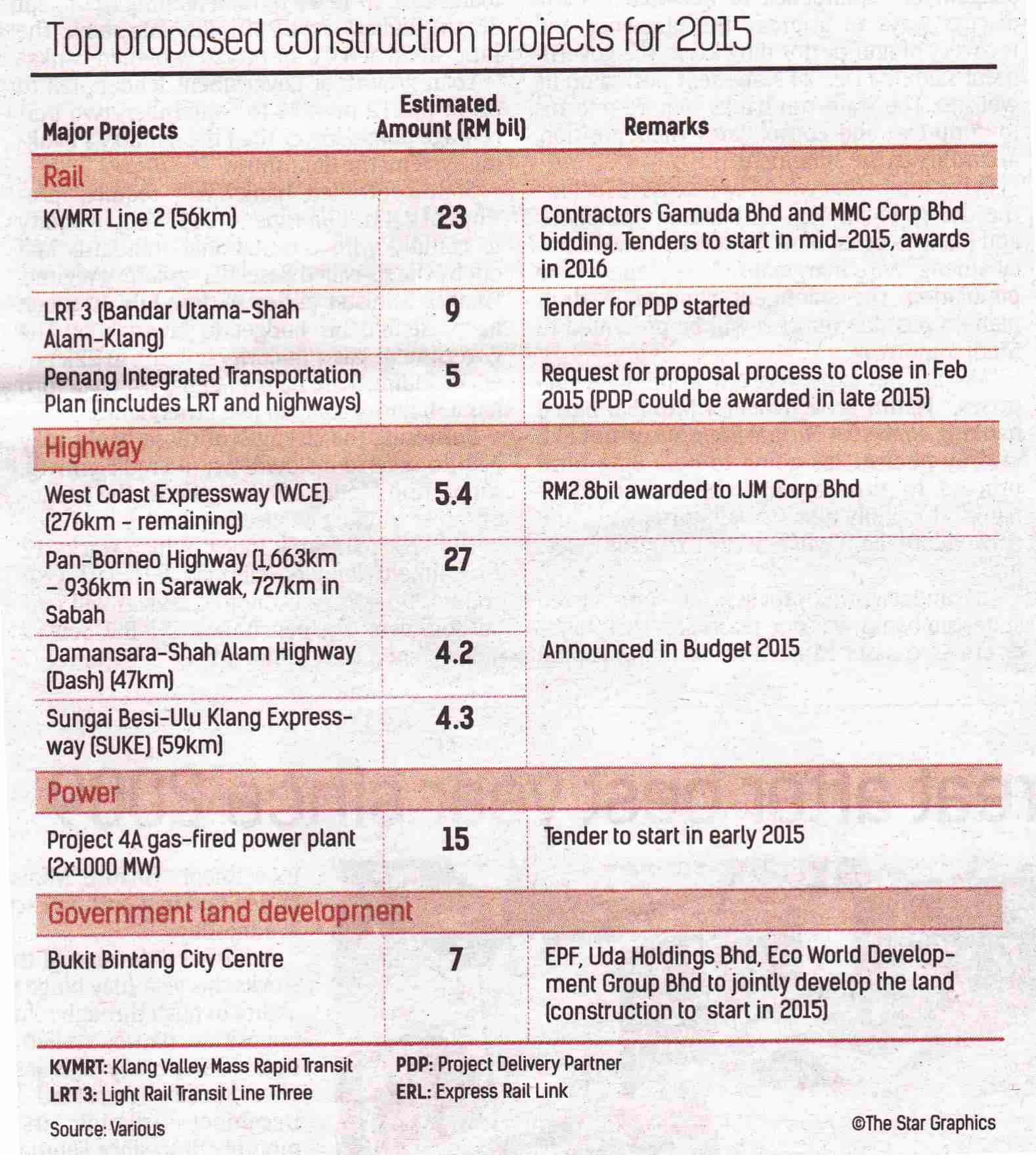

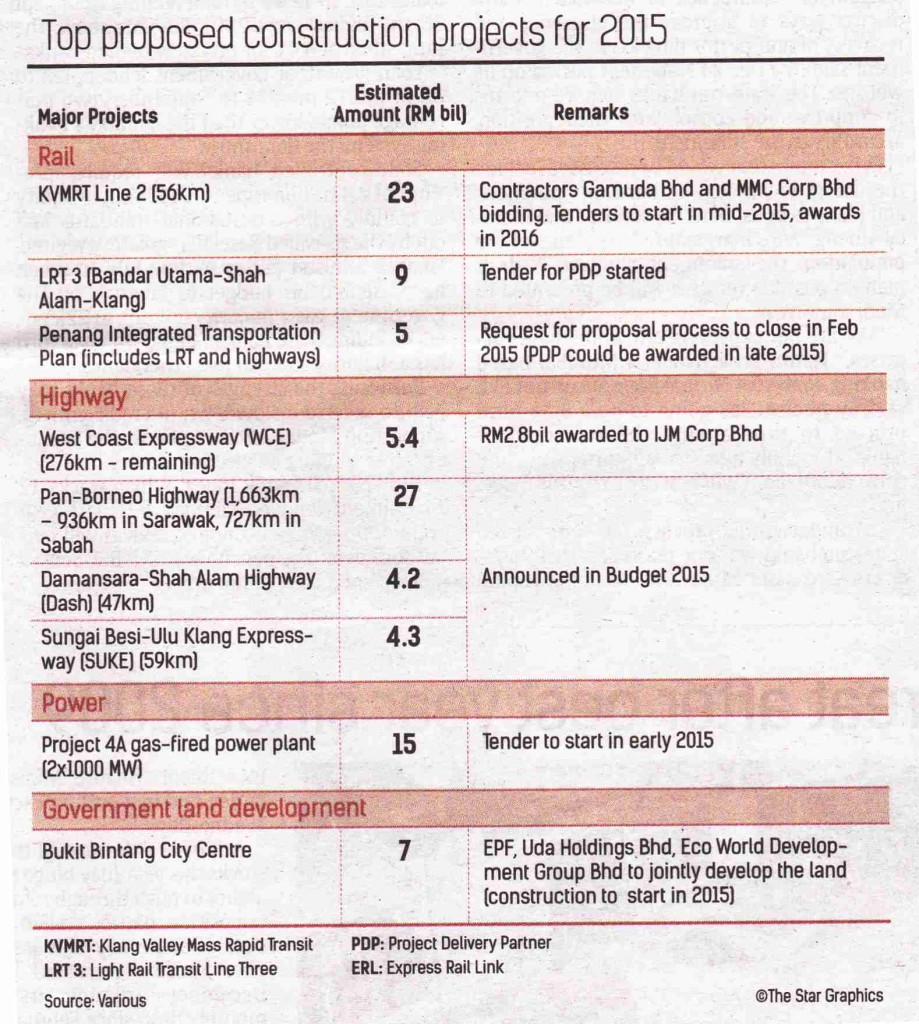

“The construction industry could face its share of challenges, although there are construction projects in the pipeline, both in the Government as well as private sectors such as the Mass Rapid Transit (MRT) Line 2, Refinery and Petrochemical Integrated Development, Warisan Tower and Tun Razak Exchange.

“However, whether these projects would take off as per schedule is left to be seen,” he noted.

With a strong possibility of cost escalation, Nathan said many might take the ‘wait and see’ approach.

“A substantial reduction in buying power will result in a challenging environment for Malaysia in 2015. Nonetheless, I am quite optimistic about the opportunities in the construction industry. The advantage for Eversendai is that many of our projects are in the United Arab Emirates, Saudi Arabia, Qatar, Oman, India and Azerbaijan, which ultimately provide larger market opportunities,” he said.

Nathan said the implementation of GST could do well if the foundation was set right and managed properly.

“For example, many contractors have projects that were initiated before the implementation of GST. How are we to account for the GST cost which was not known prior to this? If a contractor is unable to claim GST from their clients, it will be extremely difficult for them (the contractor) to absorb the 6%,” he said.

He added that the longer the GST exclusion list, the more difficult it was for companies to manage, which he noted was an issue that needed to be addressed.

However, Bina Puri Sdn Bhd group executive director and Malaysian Builders Association president Matthew Tee said he expected double-digit growth for the construction industry, buoyed by steady contract flows and ongoing jobs.

He said the Government’s budget estimates that projected the country’s economy to grow at 5%-6% this year was achievable, which would boost investors’ confidence.

“In order to visualise this growth, contract flows from the remnant mega projects under the 10th Malaysia Plan and Economic Transformation Programme (ETP) must be timely,” he noted.

Gabungan AQRS chief executive officer Alvin Ng also expected the construction industry to remain resilient in 2015 due to the stronger sector GDP growth of 9.6% in the third quarter of 2014 as well as the announcement of seven new infrastructure projects in Budget 2015 in addition to the ongoing ones.

“Projects like the 56km MRT Line 2, Light Rail Transit Line 3, Pan-Borneo Highway and the Pengerang Integrated Petroleum Complex are expected to boost the economy by increasing job opportunities and drive supporting industries.

“Although, the pace of the contract awards in 2014 was relatively low, the temporary slowdown is expected to improve this year on the back of various mega projects,” Ng said.

With a construction order book of RM1.75bil and a large tender book of projects, including launches of four development projects in and near Klang Valley in 2015 (with gross development value (GDV) of RM1bil), Ng said this would be sufficient to keep the company busy for the next three years.

According to Alliance DBS Research, Malaysia’s growth is expected to soften to 5% in 2015, slower than its previous forecast of 5.2% and an estimated 5.8% for 2014.

Among the issues to be addressed by the Government, it said, would be to rationalise the huge subsidy bill to alleviate concerns over a persistent fiscal deficit and misallocation of economic resources.

“Over the last 10 years, the subsidy bill had increased by 648% to RM43.3bil in 2013. Fuel subsidy, which made up 58% of the total subsidy in 2013, was the main culprit that drove up subsidies due to rising car ownership as well as higher crude oil prices.

“As such, a series of subsidy cuts covering electricity, natural gas, RON 95 petrol and diesel was initiated in 2014, which led to cost-push inflation,” it said in its market focus statement, adding that the consumer price index (CPI) rose 3.2% in the 10th month of 2014 compared to the long-term average of 2.2%.

“The implementation of GST would help improve Malaysia’s fiscal position in the long run, but would trigger higher inflation in the near term,” it said, projecting CPI to increase by 4.2% in 2015 versus 3.2% (estimate) in 2014.

It maintains its “overweight” call on the construction sector due to the continued Government spending on infrastructure projects as well as projects under the Economic Transformation Programme (ETP).

Meanwhile, Maybank IB Research said it expected a slowdown in job awards in 2015 due to the dull property sector outlook and Klang Valley MRT2 jobs to be awarded only in 2016.

Read more here.